Helping Clients Pursue the Financial Outcomes They Desire

The RVR Group, founded in 1996, understands that managing substantial wealth is an intricate balance. On the one hand, we work to harness the far-reaching global potential of wealth through strategies as complex as the investment of profits from the sale of a company. On the other, we apply an equally adept focus on the human side of great wealth, providing services that may be as personal as the passing of an inheritance to the younger generation or based on values that guide your philanthropic efforts.

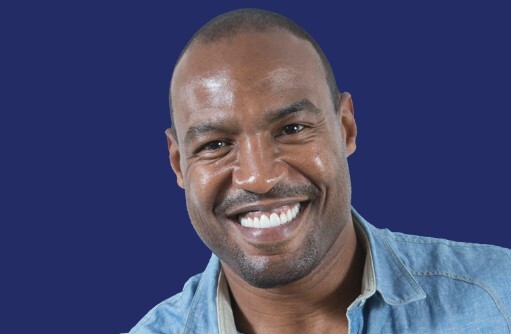

Drawing on approximately two decades of professional experience, Private Wealth Advisors Rebecca Rothstein and Mark Varo concentrate on serving a select number of ultra-high-net-worth individuals and families. This allows them to devote the necessary time and understanding to help each client address the financial challenges—including retirement and tax minimization strategies—that can accompany great wealth.

To deliver the personal attention and responsiveness they believe clients deserve, Rebecca and Mark partner with Evan Rothstein and Edward Ahn, Merrill Senior Financial Advisors who can add insurance and investment analytics to the RVR Group's overall capabilities, in addition to providing access to Bank of America's trust and estate planning services. This emphasis on teamwork helps us create a personalized financial strategy for each client, including in-depth analyses, tracking and a wide range of targeted reports to help clients understand where they are and where they may be headed.

Merrill Private Wealth Management

Merrill Private Wealth Management provides tailored strategies to help meet the distinct needs of individuals and families with substantial wealth. Clients are served with a boutique-like approach by teams of rigorously trained and experienced advisors who are skilled in working with wealthy clients, their families and businesses. Clients can enjoy a caliber of resources and future-focused strategies that is typically reserved for the world's largest enterprises. The PWM Accreditation Program identifies financial advisors who demonstrate the technical proficiency necessary to deliver exceptional service exclusively to ultra-high-net-worth individuals.

Merrill Lynch Wealth Management

Merrill offers a broad range of brokerage, investment advisory and other services, including insurance and investment analytics. Our advisors are available to work closely with clients' other trusted advisors, including accountants and attorneys. We can provide access to trust and estate planning services through Bank of America specialists.

*Trust, fiduciary, and investment management services are provided by Bank of America, N.A., Member FDIC, and wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”), and its agents.

Our Philosophy

We believe your unique goals should be at the center of all of your financial decisions and form the foundation of your financial strategy. Because significant wealth requires customized goals-based financial strategies, we believe in building lasting relationships with a limited number of clients, taking the time to understand your most important priorities for today, tomorrow and your long-term future. Our philosophy celebrates collaboration. Working with a team of specialists, we draw on the resources and insights of a global financial institution to create strategies that reflect your aspirations for yourself and current and future generations of your family. Finally, we believe that while significant wealth brings complex challenges, our experience, passion and perspectives can help you simplify your life.

An Elite Clientele With Special Needs and Challenges

The RVR Group serves entrepreneurs, company founders, private business owners, public company executives, athletes, entertainers and real estate executives. Although each client is unique, all are driven, ambitious people who look to us to help address and coordinate their wealth management.

Business Owners and EntrepreneursWe can assist corporate executives and entrepreneurs in a wide range of financial areas:

- Business succession strategies

- Wealth transfer and gifting strategies

- Retirement plan services, including 401(k)s, profit-sharing programs, defined-benefit/pension plans and nonqualified deferred-compensation plans

- Business insurance needs, including key-man and buy-sell policies

Through Bank of America, we can also offer access to help with:

- Capital-raising strategies

- Home financing

- Credit and lending services, including securities-based lending

- Commercial property lending

- Lines of credit and cash management

- Guidance with mergers, acquisitions and initial public offerings

Athletes and EntertainersBecause of the uncertainties of their professions, athletes and entertainers face special wealth management challenges. Whether you are just launching your career or are a successful veteran, we can assist you in managing your money and making sound investment decisions to help set you on the road toward your goals for the future.

"We are committed to doing what it takes to respond to clients' requests, answer their questions and address their financial concerns."Rebecca Rothstein

Managing Director

Private Wealth Advisor

A Single Point of Contact for Your Wealth Management

We supplement our own knowledge and experience with the thought leadership of Merrill and access to the banking convenience of Bank of America. Drawing on the insights of specialists and analysts from around the globe helps us provide sophisticated services designed to tend to the different elements of clients' financial life, no matter how complex.

Concentrated Stock and Equity Compensation StrategiesWe are well versed in helping manage complex compensation packages, including company stock options, restricted stock and nonqualified deferred compensation. Based on your other holdings and risk tolerance, your expectations for future growth and your time horizon, we may recommend such strategies as creating liquidity through:

- Open-market sales

- Securities-based lending

- Trading programs in compliance with SEC Rules 144 and 10b5-1

Trust, Philanthropic and Estate Planning ServicesTapping the resources of Bank of America, we can help you develop efficient and effective ways to support your philanthropic endeavors. In collaboration with specialists in trusts, philanthropy and institutional consulting, we can assist with:

- Family foundations

- Donor-advised and other charitable trusts

- Estate administration and settlement

We can also work with trust and wealth structuring professionals to help you transfer wealth and develop strategies designed to help secure your family's legacy through vehicles like:

- Living and irrevocable personal trusts

- Family and marital trusts

- Dynasty and other special-purpose trusts

Family Office ServicesWorking closely with the Merrill Family Office Services and your own accountants, attorneys and other professionals, we can provide family-focused services such as:

- Special asset acquisition analysis

- Financial statement reporting, personal cash flow planning, household account management and bill payment

- Family partnership/LLC advisory services

- Risk management and insurance consulting

"Our goal is to provide a strong foundation for building clients' wealth with reduced volatility. We seek to maximize returns based on a client's tolerance for risk."Rebecca Rothstein

Managing Director

Private Wealth Advisor

*Merrill Family Office Services are offered through Merrill Lynch, Pierce, Fenner&Smith Incorporated (“Merrill”). In connection with its Family Office Services, Merrill is not acting in the capacity as a broker-dealer, nor as a registered investment adviser. Accordingly, through its Family Office Services, Merrill is not offering, and its clients are not paying for, advice with respect to securities, the purchase or sale of securities, or the valuation thereof, nor do Merrill’s Family Office Services encompass financial planning, discretionary account management, or any other securities-related accounts, products or services. Merrill offers a broad array of brokerage and investment advisory accounts, products and services through other parts of its business outside of Family Office Services, which are subject to separate agreements, disclosures, and fee arrangements, and may be procured by applying or enrolling and contracting through those other business channels. Please contact your Financial Advisor or Private Wealth Advisor with questions regarding Merrill's brokerage or investment advisory offerings.

Family Office Services can provide tax advice; however, Merrill, its affiliates and financial advisors do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

*Trust, fiduciary, and investment management services are provided by Bank of America, N.A., Member FDIC, and wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”), and its agents. Bank of America Private Bank is a division of Bank of America, N.A.

A Holistic Approach Tailored to Your Individual Needs

Managing substantial private wealth requires highly sophisticated strategies. We try to gain a complete picture of who you are and what you want to accomplish. This helps us develop customized strategies tailored to your needs, goals, time horizon, liquidity requirements and risk tolerance.

A notable strength of our practice is our ability to complement and collaborate with your circle of advisors—including agents, business managers, accountants, legal advisors and insurance professionals—to help integrate the various aspects of your financial life.

Professional Asset Management

A key element of our investment approach is a balanced portfolio, broadly diversified among various noncorrelated asset classes and often utilizing exchange-traded funds. In addition to allowing you to potentially benefit from different markets and sectors, diversification can help lower volatility, which is particularly important in today's variable financial environment. We examine your accounts regularly and adjust your allocations if the risk level is too high or too low, given your risk tolerance and financial goals.

Merrill Private Wealth Management Professionals

Our Private Wealth Advisors and Senior Financial Advisors provide clients with a direct line to all the resources and capabilities of a truly global investment firm—in ways that are more in keeping with a small, very exclusive boutique-like atmosphere. Concierge services, family meetings, and private seminars and events are all part of the experience.

"We're always speaking with clients and asking about what's going on in their lives. We look at every conversation as a way to discover more about them and help build investment portfolios that can help to provide a firm foundation for their long-term needs."

Mark Varo

Managing Director

Private Wealth Advisor

A Commitment to Service

Merrill Private Wealth Management is committed to providing a select group of clients with highly personalized one-on-one service. When you work with us, our knowledgeable, rigorously trained private wealth advisors will gain a deep understanding of your goals, help you develop a multigenerational wealth strategy, and help you update your strategy as needed. We are committed to providing you access to the investment insights of Merrill and the banking convenience of Bank of America, and Merrill will continue to invest in client tools and new technology to enhance your overall experience as you and your private wealth advisor pursue what’s most important to you.

.jpg?width=336)

You are now leaving Bank of America Merrill Lynch.

By clicking Continue, you will be taken to a website that is not affiliated with Bank of America Merrill Lynch and may offer a different privacy policy and level of security. Bank of America Merrill Lynch is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, products or services that are offered or expressed on other websites.

You can click the Cancel button now to return to the previous page.