A collaborative relationship based on trust and transparency is the commitment behind our customized advice and guidance and strategies

The Smith-Davis-Morse Group offers tailored strategies to help meet the distinct needs of families with substantial wealth. A select group of clients is served by our boutique-like approach, and our experienced private wealth advisors are skilled in working with wealthy clients, their families and their businesses.

As part of Merrill Private Wealth Management, we are committed to serving clients with a high caliber of future-focused strategies and sophisticated services designed to cater to virtually every financial requirement. Through The Smith-Davis-Morse Group, clients have access to all the investment insights of Merrill and the banking convenience of Bank of America.

We invite you to explore how our insights, understanding, global capabilities and strategies can help you pursue your life goals, sustain your financial independence and shape your legacy.

"We combine the resources of a truly global firm with the sensibilities and one-on-one relationships usually found only in smaller organizations."

John Q Smith

Private Wealth Advisor

Our Philosophy

We believe your unique goals should be at the center of all of your financial decisions and form the foundation of your financial strategy. Because significant wealth requires customized goals-based financial strategies, we believe in building lasting relationships with a limited number of clients, taking the time to understand your most important priorities for today, tomorrow and your long-term future. Our philosophy celebrates collaboration. Working with a team of specialists, we draw on the resources and insights of a global financial institution to create strategies that reflect your aspirations for yourself and current and future generations of your family. Finally, we believe that while significant wealth brings complex challenges, our experience, passion and perspectives can help you simplify your life.

Building trust and lasting relationships

The Smith-Davis-Morse Group offers customized financial advice and investment guidance, plus access to a full range of banking services through Bank of America, to affluent individuals and families. Our Chicago-based group helps these clients manage financial and investment risk in the present and maintain their wealth for the future.

With more than 60 years of combined experience addressing clients' complex financial needs, our private wealth advisors use a process that incorporates our skill and experience with the deep, worldwide intellectual capital of Merrill Private Wealth Management. We believe a truly personalized wealth strategy extends beyond asset allocation and financial strategies. It requires a high level of personal attention and responsiveness, for which there is no substitute.

We make it a priority to listen carefully to you in order to understand your needs, your goals, your family situation and how you envision your legacy. Only then can we thoughtfully create a framework to help you make financial decisions with clarity.

We have a small, select clientele. This enables us to be readily accessible and to immerse ourselves in the many aspects of your financial life. We believe in building personalized relationships that foster enduring trust and mutual respect. Such relationships drive our customized financial advice and guidance and wealth management strategies.

Our team will work closely with you to help you manage the responsibilities that accompany wealth, such as philanthropic initiatives, intergenerational wealth transfers and other legacy issues.

The Smith-Davis-Morse Group's private wealth advisors will help you develop diversified investment portfolios specifically designed to help meet your income needs and potentially generate positive investment returns after taxes, fees and inflation, with a level of portfolio risk that is appropriate for you.

We invite you to explore how our insights and global capabilities can help you pursue your life goals, sustain your financial independence and shape your legacy.

A focus on clients with complex financial lives

Merrill Private Wealth Management is dedicated to clients with a minimum of $10 million in investable assets. The Smith-Davis-Morse Group counts among its clients successful entrepreneurs, company founders, private business owners and senior corporate executives, including several current and former Fortune 500 CEOs and other C-suite executives.

Bank of America Corporation, through its affiliates, serves clients in more than 150 countries and has relationships with 96 percent of the U.S. Fortune 1000 companies and 81 percent of the Global Fortune 500. (Source: Bank of America Corporation, March 2016)

Join an Exclusive Client GroupAlthough each client is unique, they often share a number of attributes:

Many have created substantial wealth in a single generation.

They are driven, ambitious people who prefer to maintain a level of control over their assets.

Many want to be actively involved in making investment decisions, and they want to understand what our team does and how we work for them.

Many seek an advisor who will take the time to offer insight and perspective, act as an analytical sounding board and guide their decision making.

We strive to fulfill this role exceedingly well, without exception. As a result, a remarkable number of client relationships have lasted years — even decades.

Personal banking capabilities to enhance your financial life

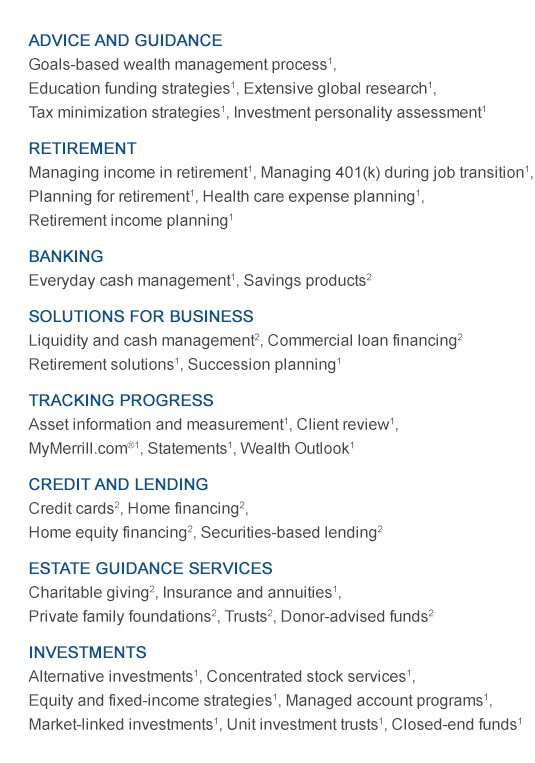

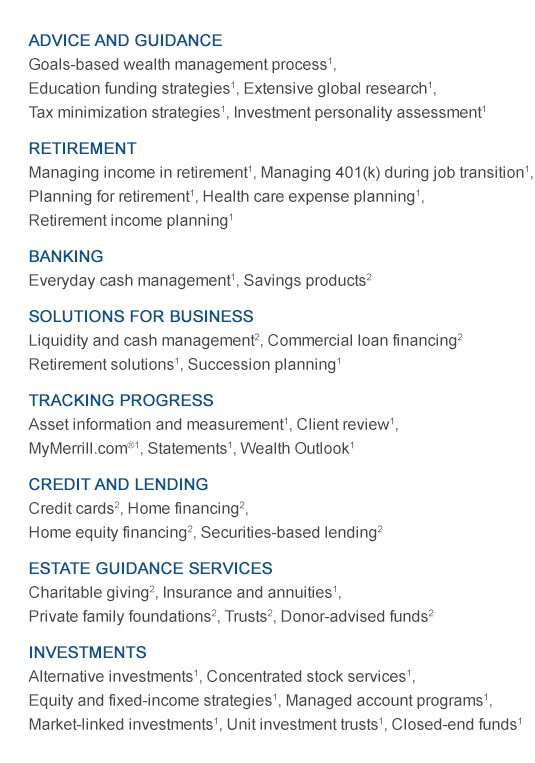

The Smith-Davis-Morse Group is your single point of contact for access to the investment insights of Merrill and the banking convenience of Bank of America. We can draw on this vast network of investment specialists, wealth strategists, global capabilities and innovative strategies to help individuals and families perpetuate their wealth, pursue life goals, preserve financial independence and shape a legacy. The breadth and depth of our capabilities allow us to guide you in many elements of your financial life, no matter how complex.

"The better we know you and your family – and understand the dynamics of your financial life – the better we can craft impactful advice and guidance and targeted strategies."James H. DavisPrivate Wealth Advisor

"The better we know you and your family – and understand the dynamics of your financial life – the better we can craft impactful advice and guidance and targeted strategies."James H. DavisPrivate Wealth Advisor

2Banking products are provided by Bank of America, N.A. and affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

*Some or all alternative investments may not be in the best interests for certain investors. Certain alternative investments carry significant risk and are not subject to the same regulatory oversight as mutual funds and other traditional investments. For these reasons, access to alternative investments may be limited to investors who are designated as sophisticated, high-net-worth investors.

*Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

*Any information presented in connection with BofA Global Research is general in nature and is not intended to provide personal investment advice. The information does not take into account the specific investment objectives, financial situation and particular needs of any specific person who may receive it. Investors should understand that statements regarding future prospects may not be realized. BofA Global Research is research produced by BofA Securities, Inc. (“BofAS”) and/or one or more of its affiliates. BofAS is a registered broker-dealer, Member SIPC, and wholly owned subsidiary of Bank of America Corporation. BofA Global Research does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

*You have choices for what to do with your 401(k) or other type of plan-sponsored accounts. Depending on your financial circumstances, needs and goals, you may choose to rollover to an IRA or convert to a Roth IRA, rollover a 401(k) from a prior employer to a 401(k) at your new employer, take a distribution, or leave the account where it is. Each choice may offer different investment options and services, fees and expenses, withdrawal options, required minimum distributions, tax treatment (particularly with reference to employer stock), and provide different protection from creditors and legal judgments. These are complex choices and should be considered with care.

An investment approach that carefully balances risk and reward

Our fundamental investment objective is to help you integrate asset allocation, diversification and compounding techniques in an effort to generate positive returns in a variety of market environments — net of taxes, fees and inflation — and to maintain the purchasing power of your investment assets over a multiyear time frame.

Asset AllocationOur investment process is dynamic and valuation-based, grounded in the concept that asset allocation, over time, can be one of the most important determinants of your investment results.

Diversified "All-Weather" PortfoliosWe guide you in developing "all-weather" portfolios that target specific financial objectives and help see you through different market environments and economic cycles.

Extended Investment UniverseTo enhance diversification and adjust the correlation among elements of your portfolio, we may recommend asset classes beyond traditional fixed-income and equities, including:

Emerging markets

Real assets

Foreign currencies

Alternative investments, such as hedge funds, private equity partnerships and managed futures

Emphasizing Tax EfficiencyWe pay close attention to the capital gains and losses certain transactions may generate. And we welcome the opportunity to work with you and your tax advisor to design a wealth management strategy that can minimize taxes — currently and for future generations — while remaining compliant with regulations.

Encouraging a Deeper Understanding of RiskThe conventional view that risk is simply a measure of portfolio volatility is too narrow. We consider other elements of risk—for instance, the possibility of permanent loss of capital or the future loss of purchasing power—to be as important as volatility. We carefully consider the potential tax impacts of financial strategies and how they may relate to business interests and other concentrated wealth.

"Conscientious risk management requires looking at your overall financial picture, taking into account every asset and liability."Jeffrey J. MorsePrivate Wealth Advisor

"Conscientious risk management requires looking at your overall financial picture, taking into account every asset and liability."Jeffrey J. MorsePrivate Wealth Advisor

*Some or all alternative investments may not be in the best interests for certain investors. Certain alternative investments carry significant risk and are not subject to the same regulatory oversight as mutual funds and other traditional investments. For these reasons, access to alternative investments may be limited to investors who are designated as sophisticated, high-net-worth investors.

*Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

*Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

A Commitment to Service

Merrill Private Wealth Management is committed to providing a select group of clients with highly personalized one-on-one service. When you work with us, our knowledgeable, rigorously trained private wealth advisors will gain a deep understanding of your goals, help you develop a multigenerational wealth strategy, and help you update your strategy as needed. We are committed to providing you access to the investment insights of Merrill and the banking convenience of Bank of America, and Merrill will continue to invest in client tools and new technology to enhance your overall experience as you and your private wealth advisor pursue what’s most important to you.

You are now leaving Bank of America Merrill Lynch.

By clicking Continue, you will be taken to a website that is not affiliated with Bank of America Merrill Lynch and may offer a different privacy policy and level of security. Bank of America Merrill Lynch is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, products or services that are offered or expressed on other websites.

You can click the Cancel button now to return to the previous page.